The Few. The Proud. The Medical—How many cash pay doctors are out there?

“To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment.”

-Ralph Waldo Emerson

It might seem wild that a doctor or hospital wouldn’t take your insurance, especially since more than 92% of Americans have at least some form of medical coverage. However, just because you have insurance doesn’t guarantee that providers accept said insurance. Anyone getting a surprise bill from their primary doctor or a hospital stay will tell you that. It’s sensible that most doctors reject at least a few plans—normally due to their location. But then you might wonder, how many doctors actually go out of their way to accept ZERO health plans? Who aims to be an outsider in one of the most risk-averse professions in the world? Does that matter for your healthcare at large? Spoiler alert: yes. Let’s go on a little adventure to find out why.

Today’s TLDR… what patients MUST know about the cash pay landscape

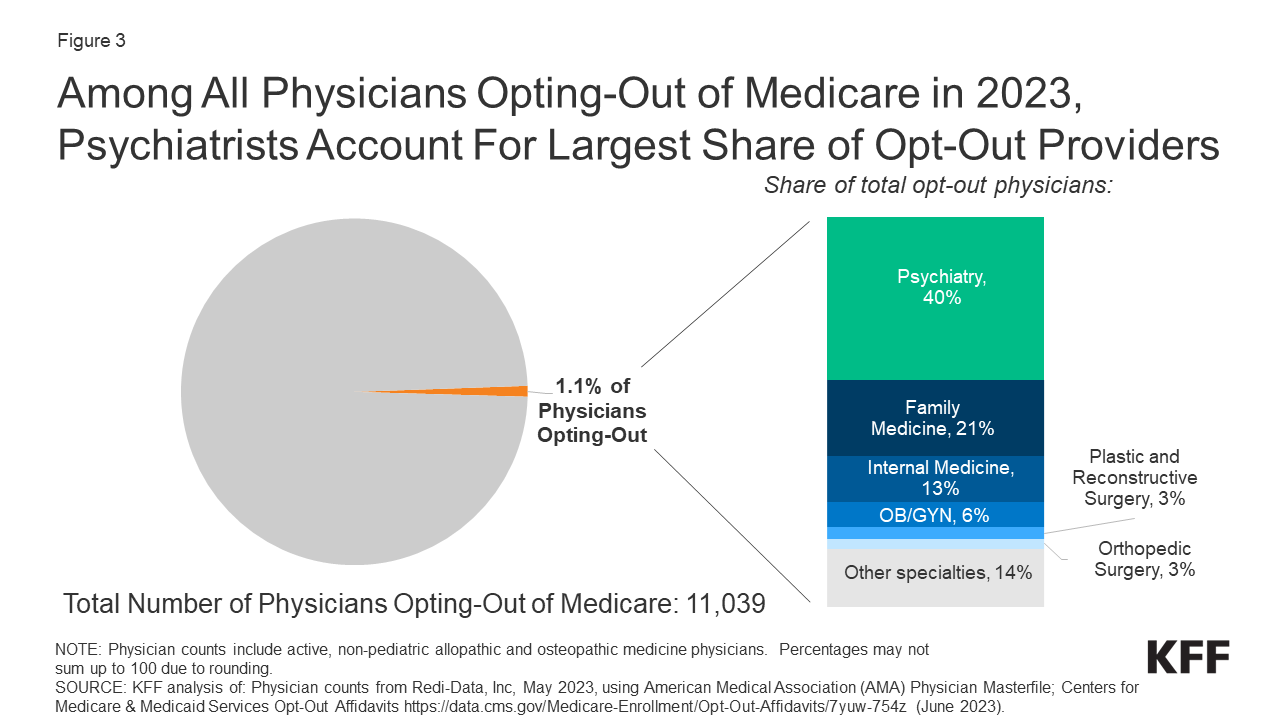

The share of US doctors who don’t take Medicare is 1.1% as of 2023. This is probably not the real share of American physicians are are 100% out-of-network. There are better reasons for an underestimate than an overestimate.

Even then, generally speaking, most doctors can’t accept every health plan—there’s too much variation between coverage

FOR PATIENTS: act as if all your future care is going to be out of pocket, even if you have bulletproof insurance. Be discerning with your care. Ask for quotes.

The lost… doctors?

Any reader of this series knows that we advocate for cash pay medicine. However, it’s critical to maintain a bit of common sense regarding medical coverage. In financial terms, it’s wise to keep your health insurance. We usually don’t choose when a severe (expensive) problem or emergency happens. But for a moment, let’s avoid anchoring to the concept that everyone should be in-network (or that patients should exclusively seek in-network providers). For today we’ll focus on the medical side (MDs and DOs) instead of including dental as well.

Providers can reject insurance plans for many reasons. But unless some major catalyst (e.g. health insurance completely breaking down) flips the entire medical practice incentive structure around, not everyone can go cash pay. Take Medicare for example. According to the CMS’s provider database, just 1.1% of all non-pediatric physicians opted out from Medicare in 2023. That implies ~11,000 physicians.

Abandoning the government payers can be untenable strictly from a volume perspective. The US (and other OECD countries) continue to age. Hence there will be more Medicare patients. Newer doctors may feel they can’t afford to drop that growing population segment over the next couple decades.

The total # of active physicians (MDs and DOs), now a bit over 1M, grew ~31% from 2008. This is still too low a supply to support every US resident, but there’s another insight here. The Medicare opt-out rate has remained steady at this ~1% level since 2013. Hence the absolute quantity of doctors opting out is higher. The proportion would have shrunk otherwise. 45 of 50 states now have opt-out rates at or above 2%. In 2020, 47 of 50 states fit the same measure.

But… what about the rest of the plans?

Medicare, although the largest insurer, is just one insurer. Just because a physician refuses medicare doesn’t mean said doctor rejects every other plan. The real share of physicians being completely out-of-network (besides with Medicare) is probably not 1.1%. There are some reasonable arguments for whether the % is higher or lower.

What if the real cash pay doctor share is HIGHER:

Consider the relationship between unemployment and underemployment. Someone working part-time as a secretary is technically employed. But if hours are too limited (normally a cost measure when the employer can’t or doesn’t want to take on extra labor capacity) or the secretary’s abilities remain unfulfilled, that is underemployment. In the realm of medicine, insurance coverage can be limited when it otherwise shouldn’t be. And with the rise of high-deductible health plans, patients are essentially paying out of pocket for healthcare anyway. Medical practices don’t enjoy chasing down high-deductible patients for reimbursement, even if the care was “in-network.”

Without going into a way-too-long macroeconomics spiel (phew), a doctor can “accept” a handful of plans but in turn remain effectively cash pay. This is where speciality plays a critical role. A cosmetic-facing specialist may formally accept Medicare but nearly 100% of the practice remains out of pocket for patients. This is because the services performed—botox, facelifts, tummy tucks, BBLs, etc.—would be rejected by Medicare (and most commercial plan) coverage anyway.

Other cosmetic-friendly specialists (like plastics or derm) may never have registered with Medicare in the first place. Those doctors won’t be included in the opt-out metrics. CMS also breaks down the disciplines where opting happens more often (see below).

What if the real cash pay doctor share is (or could become) LOWER:

More physicians may reject Medicare in particular but retain most commercial plans—the latter pay more. Medicare physician payments declining since 2001 influences that behavior. Frankly, there is no reliable, aggregated data (at this time) showing what share of physicians are on what commercial plans. Private insurers do not want that transparency, as competitors would attempt to renegotiate contracts in opposition.

Severe economic recessions can disincentivize both doctors building cash pay clinics and patients seeking out of pocket services. This catalyst would have to be deeper than the COVID-19 pandemic-induced crash, which, in retrospect, lasted just three months (in terms of economic activity).

As mentioned earlier, the Medicare population grows as more patients live longer and age. Doctors far away from retirement may not want to miss that wave. If Medicare takes up 50%-60% of your practice volume, it might be catastrophic to cut them off like a remorseful breakup with a high school sweetheart. Of course, if a clinic is seeing those Medicare patients at a loss, the strategy changes.

So, what should patients do?

Patients must operate as if they are going to pay for most or all of their care. This mindset lets patients become more discerning with their choices. It’s not just about finding the cheapest option. Seeking the place that can best serve you, at the lowest cost, with appropriate convenience, is a better aim. To which you say, “I’m already paying a king’s ransom for the insurance I have—why do things out of pocket?” But as health plans raise their deductibles and shrink their drug formularies every year, that insurance card may be as useful as a wet blanket in a thunderstorm.

Here are a few starter questions to ask a cash pay clinic, with the above context in mind:

Can you give me a quote or estimate for an office visit? What about for procedure XYZ? Are the fees negotiable?

Does your practice accept Health Savings Accounts or Flexible Spending Accounts?

Can I bill the insurance company myself if your clinic will not do so? Make sure to check your out-of-network benefits from the insurance plan. We’ll have more of these in a separate FAQ article. Stay tuned!

In any case, it’s critical for patients to navigate their care with a cash approach in mind. Even when using insurance. And especially because cash pay medicine is expected to grow ~10% a year (per Grand View Research) through 2030.

Wondering how to find a competent direct pay doctor? Contact us on Substack or @caretocash on x.com for personalized guidance.